Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

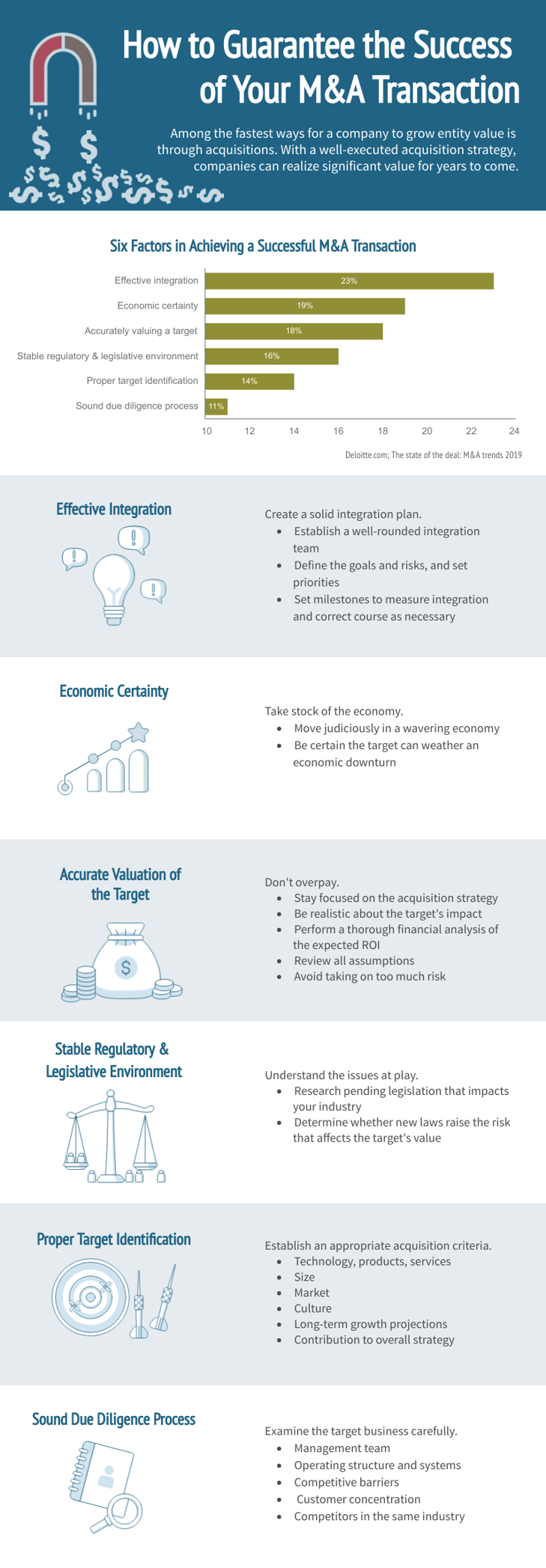

A well-executed acquisition strategy is one of the fastest ways for your company to grow its value. By accumulating acquisitions, your company can realize significant value in the first year, often followed by accelerating growth for years to come. That’s why spending the time now to develop a thoughtful mergers and acquisitions strategy—with well-planned criteria for defining successful acquisition targets—is vital.

A well-executed acquisition strategy is one of the fastest ways for your company to grow its value. By accumulating acquisitions, your company can realize significant value in the first year, often followed by accelerating growth for years to come. That’s why spending the time now to develop a thoughtful mergers and acquisitions strategy—with well-planned criteria for defining successful acquisition targets—is vital.

Perhaps your particular industry is highly fragmented, in which case consolidation is a smart and prudent strategy for growth. Yet even if your company operates in a consolidated sector, targeted acquisitions can be remarkably fruitful. Whatever your niche, function, or specialty, success can be yours if you remain true to your M&A strategy, adhering to your goals for the transaction throughout the acquisition process.

When your company is ready to explore expansion through acquisition, focusing on certain key factors of the deal process leads to higher success rates, according to a recent study performed by Deloitte. Each of the six factors described below is crucial to ensuring a positive outcome for your business.

Realistic planning is critical to success—without it, you could lose out on any expected synergies from the acquisition. All the financial projections might make perfect sense, but they will not be meaningful without a solid integration plan. Clearly define the goals and risks of the deal, and set your integration priorities accordingly. Establish a plan with milestones that measure integration of the target business, so corrections can be made as needed. Create an integration team composed of key people from each of the major business groups, including sales, marketing, operations, finance and accounting, human resources, legal, and IT. Your team will be critical in evaluating the acquisition against your metrics and integrating it into your business.

When the economy is strong and confidence is high, you will be able to extract greater value from an acquisition. If the economy appears to waver, however, it might be time to rethink your move forward. Economic headwinds could negatively impact the acquisition’s financial performance, lowering profits and the potential return. As an acquirer, you should feel comfortable with both the prevailing economic environment and the target’s ability to weather any economic downturn.

Accurate Valuation of the Target

Amid the excitement and frenzy of negotiations, many companies overpay for acquisitions. To avoid this disastrous situation, remain disciplined in your approach and focused on your acquisition strategy. Be realistic about the target’s impact on your bottom line, by performing diligent financial analysis of the expected return on investment and cash payback. During negotiations, take the time to review your assumptions. How much bank debt will you be acquiring? How much capital should you put into the deal? Have you lined up strong, trustworthy relationships with lenders? Exploring these questions is paramount in mitigating potential failure.

Stable Regulatory and Legislative Environment

Understanding how the government could affect potential acquisitions can be critical. New laws or complicated regulations often cause risk to increase, which may impact a target’s value. Be sure to research pending legislation that will affect the target company or its industry. Trade associations can be a great resource, too, in investigating whether the legal and regulatory environment is stable—an essential factor in the success of any acquisition.

Proper Target Identification

Many acquirers do not take the time to develop proprietary deal flow, instead responding only to the transactions presented to them. Instead, seek opportunities through a proactive marketing effort, by determining the specific criteria (size, market, culture, long-term growth projections) for acquisition targets that suit your company—and by sticking to benchmarks you’ve established. A dedicated effort to identify the right targets can guide your acquisition strategy and help you avoid auctions, which often lead to higher valuations.

Sound Due Diligence Process

In any M&A transaction, a sound due diligence process wins the day. As an acquirer, you’ll find it essential to examine the target business carefully. Start by looking at the management team: Do they have the depth and talent you require? Review the operating structure and systems to ascertain the quality of their data: Will you need to make significant investments to bring the company up to acceptable standards? Also, determine whether the target company has competitive barriers or a protected position in the market. Then assess customer concentration, especially if the target’s customers represent more than 10% of its revenue stream. Finally, compare the target business with its competitors in the same industry. Fully understanding the issues you face and setting acceptable thresholds for each target will allow you to accurately weigh your options against the goals you’ve set for the transaction.

To have the greatest chance for success, build an experienced deal team to help you examine the issues described above. Key components of this group include an investment bank, which will quarterback the process and help with valuation, due diligence, negotiations, and prospecting for targets; an accounting firm, which will thoroughly review the financials to make sure the numbers are real; and a law firm, which will work to structure the agreements and protect you if something goes wrong. Together, your deal team can assess the transaction and ensure the deal is properly vetted and structured.

When considering growth through acquisitions, you will need to weigh a wide range of factors. A deliberate, calculated business strategy and a well-designed integration plan will create the highest probability of success for your company. And if the deal does not appear to accomplish the goals you originally set out to achieve, the best solution might simply be to walk away.

PCE has guided numerous companies through acquisition planning and execution. Please contact us so we can tell you about our experienced team and our highly useful services or answer any questions you may have.

Investment Banking

mrosendahl@pcecompanies.com

New York Office

407-621-2100 (main)

201-444-6280 Ext 1 (direct)

407-621-2199 (fax)

Investment Banking

Chicago Office

224-520-1068 (direct)

nicolek@pcecompanies.com

Connect

224-520-1068 (direct)

407-621-2199 (fax)