Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

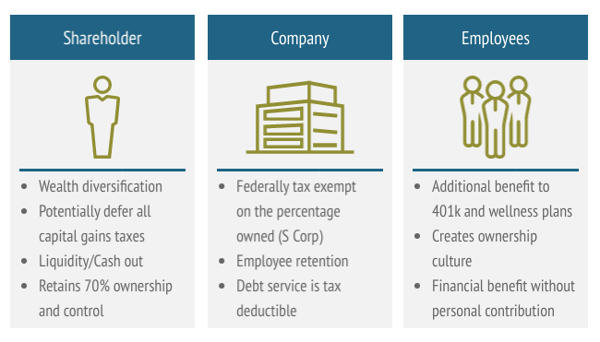

A Home Run for Shareholders, Businesses and Employees

As privately held businesses mature and grow in value, the desire for, and prudence of, personal liquidity and diversification grows in importance to business owners. When much of one’s personal net worth is tied to a highly successful yet illiquid business, the owner is often faced with the question “How can I personally diversify yet continue to run my company successfully and provide meaningful benefits to my employees?”

The use of an Employee Stock Ownership Plan, or “ESOP”, provides business owners a distinct advantage regarding personal liquidity and business transaction. The ESOP allows the business owner to cash out a portion of her/his business and retain their role in the company while providing excellent tax benefits to both the shareholder and the company. Furthermore, the benefits an ESOP provides to the company and its employees are significant, making the ESOP a triple play liquidity strategy.

Value is often at the forefront of the business owner’s mind when she/he begins to evaluate liquidity strategies. The value of a company whose shares are sold to an ESOP is determined by a valuation approach that centers on Fair Market Value (“FMV”). When the FMV of the business is established, the business owner can determine how much liquidity she/he desires to diversify personal holdings. The ability to control the percentage of the business being sold is just one of the reasons ESOPs are so appealing to business owners.

It is only natural that business owners want to retain the legacy of a business they have spent years building. Most other business divestiture options would require a majority or full sale of the business, but an ESOP does not. The ESOP is a financial buyer and passive investor that is indifferent as to the percentage of the company it owns, including a minority position. The actual shares are held within a trust that is governed by a fiduciary.

While the employees do not own the shares directly, they are the beneficiary of the trust and all assets owned within the trust. This indirect ownership model does not provide a mechanism for day-to-day control by the ESOP participants. From a governance perspective, the company often operates the same post-transaction as it did pre-transaction; this is particularly true in the case of a partial sale to an ESOP. This partial sale allows the current owner(s) to retain the majority of the equity value while still providing a meaningful benefit to the ESOP participants.

The capital markets remain robust and available with favorable terms for ESOP transactions, especially, in a partial/minority sale to an ESOP. An S corporation ESOP pays no federal tax on its percentage of ownership income and allows for increased cash flow to repay bank debt. Banks and capital providers welcome the minority ESOP transaction, which allows them to get comfortable with the business operations without having too much leverage on the company, allowing the company adequate cash flow to service its debts and fund its operations. Read more about ESOP Tax Advantages.

When the ESOP participants assume the employee-owner mentality, they tend to think more about the business’s day-to-day operations and how their choices affect the business as a whole, resulting in a positive culture and overall improvements for themselves, the company, and any other shareholders. Further, the employees are likely to receive above average returns on the stock.

The benefits of ESOPs are not just theoretical and qualitative. According to the National Center for Employee Ownership (NCEO) 1, ESOP companies are 25% more likely to remain in business and over a 10-year period also experience 25% higher job growth than comparable non-ESOP-owned companies. The NCEO found that employee-owners were four times less likely to be laid off during the most recent recession, affording employee-owners greater job stability and benefiting companies through strong employee retention. Ultimately, the enhanced productivity results in higher sales (approximately 2.3% per year). For an employee owner, this translates into an average retirement account that is 2.5 times larger than comparable non-ESOP-owned employee retirement accounts.

Further highlighting the ESOP’s tremendous benefit, the NCEO created the Employee Ownership (EO) Index in 2017. Over a two-year period (2017–2019), the EO Index outperformed both the S&P 500 and the Russell 3000 in each of those years. Over that two-year period, the return of the EO Index was 48.1%, compared with 24.1% and 24.2% for the S&P 500 and Russell 3000, respectively. 2

The example below considers a 30% sale to an ESOP and highlights some of the benefits provided to all involved.

As a business owner, it is vital to contemplate the transition from equity to cash. Taking steps to entertain all options will provide you with a path toward achieving your goals. An ESOP will give you the ability to achieve all your objectives while providing powerful tax advantages and employee benefits to retain and attract talent. Selling a minority position in your company to an ESOP allows you to retain the majority of equity that provides increased stock value as your business continues to grow and prosper. For more information on how an ESOP will benefit you, please contact us or visit our website and PCE’s ESOP Library of Information.

[1] NCEO. The Economic Power of Employee Ownership

[2] Rodgers, Loren. NCEO. NCEO Employee Ownership Stock Index Continues to Double Market Returns, July 1, 2019.

Investment Banking | ESOP

ezaleski@pcecompanies.com

Chicago Office

407-621-2100 (main)

847-239-2466 (direct)

407-621-2199 (fax)

Investment Banking | ESOP

Chicago Office

847-239-2466 (direct)

ezaleski@pcecompanies.com

Connect

847-239-2466 (direct)

407-621-2199 (fax)