Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

For business owners planning a sale in the mergers and acquisitions (M&A) environment, “It’s nothing personal” doesn’t always apply. During your company’s sale or liquidation process, you’ll want to consider not just the existence of goodwill, but whether any of it is deemed personal. This explanation of goodwill and review of Tax Court rulings highlights the benefits of personal goodwill—in terms of recognition, value, and cost savings—when your business liquidates or distributes proceeds from an asset sale.

The IRS defines goodwill as “the value of a trade or business attributable to the expectancy of continued customer patronage.”1 Traditionally referred to as “business goodwill,” this type of goodwill is owned by your company and associated with operating the business. It can come in the form of, for example, brand recognition, domain names, and reputation—all of which can lead to competitive advantages within the marketplace.

Goodwill typically arises during a business combination2 and is the portion of the purchase price in excess of identifiable assets and assumed liabilities.3 The IRS identifies goodwill under Section 197 as one of twelve categories of intangible assets that can be acquired and amortized over 15 years on a straight-line basis:1

While business goodwill can be traced back to the company, personal goodwill is attributable instead to a particular owner or individual actively participating in the company. In other words, personal goodwill is an intangible asset owned by an individual and not considered a corporate asset. And if you can establish the existence, value, and transferability of personal goodwill before a future liquidation or proposed asset sale, this may deliver significant income tax savings.

Regardless of whether goodwill is deemed business or personal, the proceeds you receive in exchange for it are typically treated as a capital gain. Proceeds on certain corporate assets are then taxed at your ordinary income rates. Personal goodwill is not considered a corporate asset, however, so as the business owner of a C corp (and in some cases, an S corp4), you receive an added layer of benefits: the proceeds on personal goodwill, when sold separately from the main asset sale, do not face double taxation. Thus, you may be able to reduce your tax liability by selling your personal goodwill—if the IRS respects it as personal goodwill by nature.

As a business owner looking to sell the corporate assets of a C corp, you may face double taxation, which can significantly reduce the total proceeds you receive for goodwill. First, your company will be taxed at a corporate rate of up to 35.0%5 on the proceeds of the assets. Then, you will be taxed at an individual long-term capital gain rate of up to 23.8%5 on the proceeds from the liquidation or distribution of those assets. Yet an alternative approach can provide clear advantages to you as the seller: transferring personal goodwill in a separate transaction prior to the potential sale of your company.

A proper valuation of your business can provide great insight into the value of your company. During a purchase price allocation, typically any excess amount paid to you over and above the value of your net identifiable assets are attributable to goodwill. And careful planning that results in the identification of such excess value and its allocation to personal goodwill can help you avoid the double taxation associated with ordinary business goodwill.

In deals where non-compete or employment agreements are created to avoid double taxation, the payments you receive can be taxed up to 37%6 as ordinary income, plus additional amounts for employment taxes. Meanwhile, with personal goodwill, the sale proceeds you receive are likely taxed once and recognized as a long-term capital gain, leaving only the remaining business goodwill subject to double taxation. So, establishing the existence of personal goodwill and transferring it before a sale can leave more money in your pocket.

When an M&A transaction arises in which value is allocated to personal goodwill as opposed to business goodwill, both you and the potential buyer could benefit from some careful planning. Are you in the midst of exit planning? Are you considering the future gifting of shares to the heirs of your estate? Your decision to allocate goodwill into either a business or a personal account may depend on your reason for the liquidation.

For tax planning purposes, you may also wish to consider the economic benefits related to your potential asset sale, such as the following:

Or perhaps your goal is to provide economic benefits to the buyer of your company:

In these ways, among others, allocating value from business goodwill to personal goodwill can provide further tax savings or other benefits during a liquidation or sale.

Although regulations vary from state to state, Tax Court rulings suggest considering a multitude of factors—from customer relations, reputation, and expertise to whether any enforceable non-compete or employment agreements are in place—when determining the existence of personal goodwill. Various landmark Tax Court decisions have set legal precedent and have sparked IRS interpretation of personal goodwill versus business goodwill.

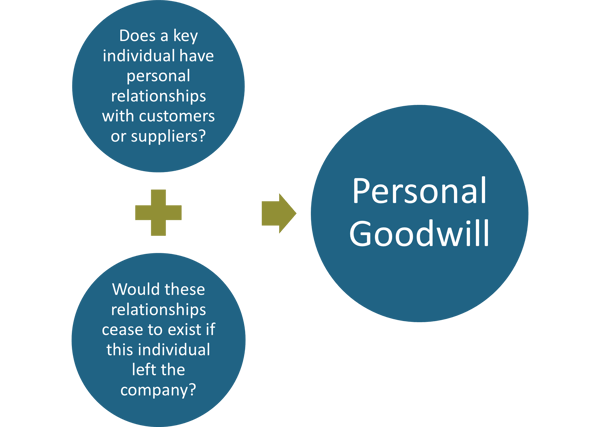

When determining whether goodwill is business or personal, the Tax Court’s ruling in Martin Ice Cream Co. v. Commissioner7 suggests considering the following:

In Martin Ice Cream, the Tax Court ruled that the shareholder’s oral agreement for distribution of products and his twenty-five-year personal relationships with his customer base were not corporate assets. The Tax Court stated, “[P]ersonal relationships of a shareholder-employee are not corporate assets when the employee has no employment contract with the corporation.” Thus, this intangible asset was owned by the shareholder and lacked transferability.

The Tax Court’s ruling in William Norwalk v. Commissioner 8, meanwhile, supports the enforceability of non-compete or employment agreements as proof of either personal or business goodwill. In this case, the owners of a C corp were subject to realize a taxable gain on the total amount of goodwill distributed to them from the C corp. The Tax Court reasoned that personal client relationships are corporate assets if individuals “enter into a covenant not to compete with the corporation or other agreement whereby their personal relationships with clients become property of the corporation.”

Before entering into any M&A process or determining the amount of your personal goodwill, you should closely examine these Tax Court rulings and others to determine where you might avoid such risks—or take advantage of any potential opportunities.

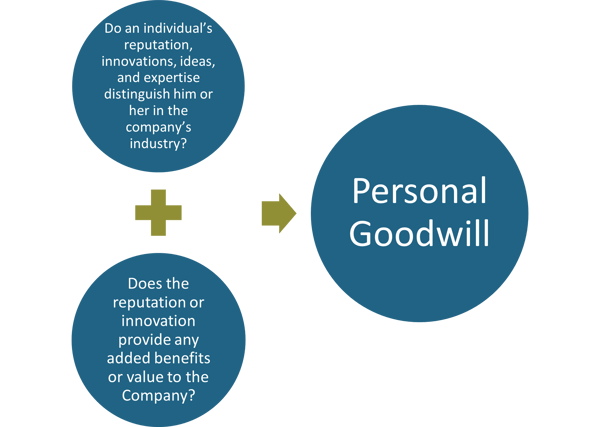

The amount of personal goodwill must be determined reasonably and objectively, and must withstand intense scrutiny from the IRS. The Tax Court ruling in Lopez v. Lopez suggests several factors that should be considered and analyzed when transferring personal goodwill, such as a particular owner or individual’s age, health, earning power, and reputation, as well as the nature and duration of the owner’s or contributing member’s business practice.

The valuation community uses various methods to quantify personal goodwill:

The identification of personal goodwill is nuanced and requires careful consideration of your unique transaction and the circumstances surrounding it. Smart, prudent business owners will consider both quantitative and qualitative approaches in determining the amount of personal goodwill present in a business.

Transferring personal goodwill in a separate sale prior to a transaction can be an effective way to reduce the taxes you’re required to pay upon the sale of your company. A plethora of legal precedence exists to guide appraisers in identifying both business and personal goodwill. When allocating value to personal goodwill, however, it is essential to understand and mitigate the risks associated with a potential IRS audit.

PCE’s knowledgeable, independent business appraisers possess the expertise to properly assist you in determining the optimal approach to goodwill, including planning and compliance. Feel free to get in touch with us if you have comments or questions about this article or want more information on this subject.

[1] 26 CFR § 1.197. See also IRS 2021 Publication 535, Business Expenses.

[2] Situations where goodwill may arise include corporate asset sales (IRC Section 331), installment sales (Section 453B), deemed asset sales (Section 338), and C corp-to-S corp conversions.

[3] Under International Financial Reporting Standards (IFRS) 3, Business Combinations.

[4] S corps with earnings and profits, or S corps subject to BIG tax.

[5] Includes maximum long-term capital gain tax rate of 20.0%, plus 3.8% for net investment income tax rate for 2022.

[6] Includes a maximum federal rate for individuals of 37.0% for 2022.

[7] Martin Ice Cream v. Commissioner 110 T.C. 189 (T.C. 1998)

[8] T.C. Memo 1998-279, William Norwalk, Transferee, et al. v. Commissioner. United States Tax Court. Filed July 30, 1998.

Valuation

rpearl@pcecompanies.com

Orlando Office

407-621-2100 (main)

407-621-2140 (direct)

407-621-2199 (fax)

Valuation

Orlando Office

407-621-2140 (direct)

rpearl@pcecompanies.com

Connect

407-621-2140 (direct)

407-621-2199 (fax)