Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

In an active M&A market, business owners are using Employee Stock Ownership Plans (ESOPs) to convert some of their illiquid privately held company stock into cash and other liquid investments. A partial ESOP strategy is particularly relevant for business owners who want to continue operating and owning a portion of their business while diversifying assets, a prudent part of personal wealth management.

ESOPs are attractive for their tax savings to the owner and company, flexible deal structures, and the speed with which a transaction can be completed. Capital markets continue to be active participants in ESOP deals and provide significant liquidity at closing, so now is a great time to evaluate this liquidity strategy.

The flexibility of a partial sale to an ESOP provides business owners the ability to do many things, including:

Consider John, a 50-year-old business owner of an electrical distribution company. John started the business 15 years ago and has achieved fantastic growth, but personal goals have him contemplating exiting the business entirely at age 60 (10 years from now). However, the uncertainty around the timing of his personal plans and whether the M&A market will be strong at that time have him evaluating a partial liquidity strategy today.

John and his advisors examine different liquidity strategies: a leveraged recap, a sale to an outside equity investor, and a partial sale to an ESOP. After careful consideration, He decides to pursue a partial sale to an ESOP for several reasons: better financing alternatives, ability to retain control, the benefit to his employees, and personal and corporate tax savings.

.png?width=600&name=Funding-of-ESOP-Purchase%20(2).png)

The debt market is a large supporter of ESOPs, providing approximately two to three times the cash flow on partial ESOP transactions. John receives offers in the $20 million range from senior lenders as well as offers for another $5–$7 million of subordinated debt. John and his investment banker decide to limit the total outside debt to $20 million, which equates to approximately 30% of the value of the business. After the transaction is completed, John will own 70% of the business and the employees will own 30% through the ESOP trust.

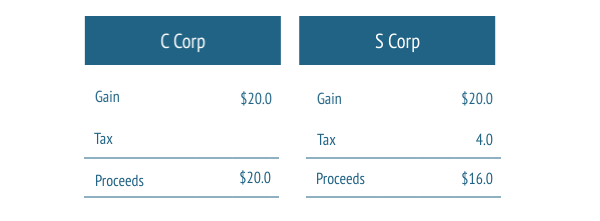

With this strategy, not only has John been able to take some cash off the table, but he has also deferred the capital gains taxes on the sale. Because he converted his company to a C corporation, John has the ability to sell his shares to the ESOP and defer all the capital gains taxes. If the company were not a C corporation, he could convert it to one before the ESOP transaction and still enjoy the capital gains deferral.

Another nice feature of ESOPs is that any corporate structure allows repayment of debt with pretax dollars, which is a huge advantage in doing a recapitalization through an ESOP.

Creating an ESOP and completing a transaction in a shorter time frame than what a sale to an outside buyer would require allows a current business owner to sell some stock in the near term while continuing to own the majority of the business for an indefinite amount of time.

While John has been able to solve his desire for liquidity, he has also realized several other benefits:

In today’s marketplace, the flexibility and benefits of a partial sale to an ESOP are incomparable, and it should be considered as a liquidity strategy.

Contact us today to get more information on how an investment banker can help you get the greatest value when selling your business. Or, visit our ESOP Planning Library to find additional resources to help guide you through the ESOP planning process.

Investment Banking | ESOP

wstewart@pcecompanies.com

Orlando Office

407-621-2100 (main)

407-621-2124 (direct)

407-621-2199 (fax)

Investment Banking | ESOP

Orlando Office

407-621-2124 (direct)

wstewart@pcecompanies.com

Connect

407-621-2124 (direct)

407-621-2199 (fax)