Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Entrepreneurial businesses are often sold to relatively disinterested third parties in order for the founder to cash out. And that frequently works out just fine for both the buyer and seller. But sometimes the personal emotional strings attached to the business, whether subtle or profound, are simply too strong to break, and the seller finds it disheartening and sometimes even impossible to turn control over to some unknown high bidder.

You may be familiar with the term “emotional capital.” Emotional capital is comprised of all the softer assets an owner has invested in their company: weekends and evenings sacrificed to develop the business instead of enjoying time with family and friends; going the extra mile to save or develop a customer; consistently forging new procedures to serve the clients better or make it a better place to work; always stretching one more hour out of the day and one more day out of the week – it’s the business of creating a business.

After all, the entrepreneur often spends more time with their “business family” than with his or her immediate family. And the gap between you, the entrepreneur, and an outsider who is never exactly like you and is unlikely to treat the business the way you treat it is huge! But that gap can be bridged.

An ESOP, or Employee Stock Ownership Plan, allows an owner to “sell” his or her stock and remain involved in the business. “Have your cake and eat it too,” some might say. It allows the owner to realize personal liquidity (turn the non-liquid, privately owned stock into cash) and continue to be involved directly in the business.

If you have faced the fact that one day you will not own your company, and you want the business to keep growing the great reputation, culture, customer list, and excellent profits you and your team created, you should consider the ESOP.

The management and key employee team you put together over the years is a valuable and often irreplaceable asset of the company, part of that “emotional capital.” An ESOP keeps this group comfortably in place while giving you, the seller, the liquidity you want.

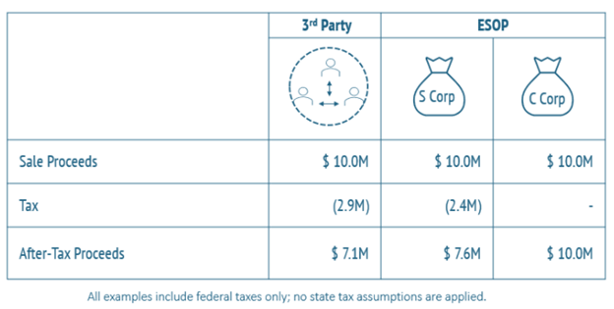

The tax advantages of an ESOP must be considered. Whether your business is an S or C corporation, there are significant tax advantages allowed in selling to an ESOP that are not found in a sale to a third party.

ESOPs provide selling shareholders the ability to sell their business as a stock transaction, which means proceeds are taxed a capital gains tax rate. As depicted in the illustration below, this contrasts with a third-party transaction where buyers typically purchase the assets of a business, and proceeds are then taxed at a blend of capital gains and ordinary income tax rates. Further, the capital gains tax on the sale of stock to the ESOP can be deferred and even eliminated in certain circumstances through the IRC Section 1042.

The company will also enjoy considerable tax advantages under ESOP ownership. The biggest advantage is that the contributions from the company to the ESOP to pay for your stock are tax deductible! There is no other ownership succession program that permits you to do this. The company saves up to 40% of the purchase price by using before-tax dollars to pay for the stock. This also enables the company to be an efficient borrower and servicer of debt, as it can reduce the debt borrowed to pay for your stock on a pre-tax basis. Dividends used to reduce principal on borrowed funds from either a seller or a bank are also tax deductible. You can learn more about ESOP tax advantages for shareholders and your company here.

Many of our clients ask us to “dual-track” the sale of their company. That is, we go to the market looking for third-party buyers and at the same time prepare an ESOP feasibility study, comparing the results of both. Competition assures that you, the seller, get the best results for yourself and the company.

If you have comments or questions about this article, or would like more information on this subject matter, please contact us.

Investment Banking | ESOP

Orlando Office

407-621-2111 (direct)

djasmund@pcecompanies.com

Connect

407-621-2111 (direct)

407-621-2199 (fax)