Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Privately owned businesses that hold debt and operating leases should prepare for significant changes to their financial statements in 2020. Loan agreements often include financial ratio covenants that must be maintained by the borrower to be compliant. New lease accounting standards have changed how operating leases are treated in financial statements, which may have a material impact on financial ratios.

Previous accounting treatment for leases required financial statement preparers to classify a lease as either a capital lease or an operating lease. The distinction has a meaningful impact on how they were presented in the financial statements.

A capital lease (or finance lease) is similar to financing the purchase of an asset. Capital leases were always presented on the balance sheet. The asset being financed appears on the balance sheet as a capital asset, and the remaining principal due is shown as debt liability. Depreciation expense and interest expense are charged through the income statement, decreasing taxable income. To classify as a capital lease under US GAAP, any one of four conditions must be met:

An advantage of capital leases is the reduction of taxable income through depreciation expense and interest expense. The disadvantage is the increased indebtedness presented on the balance sheet.

An operating lease is more like renting an asset. Historically, operating leases did not appear on the balance sheet, but rather as a note to the financial statement, because there was no assumption of ownership. Annual lease payments are expensed through the income statement, but depreciation and interest expense were not permitted.

Operating leases provide companies greater flexibility as they can replace/update their equipment more often since they are not purchasing the assets. However, the most significant advantage of the operating lease is its ability to exclude lease liabilities from the balance sheet.

Operating leases are often associated with off–balance sheet financing. Since operating leases are liabilities excluded from the balance sheet, they would reduce the business’s perceived indebtedness. Some companies would engineer their lease agreements to qualify as operating leases under US GAAP when they were capital leases in substance. Companies would use this financial engineering to manipulate debt coverage ratios and hide capital leases off–balance sheet.

On February 25, 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2016-02, Leases (Topic 842), to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing transactions.[1] In simple terms, the new lease accounting standard requires companies to present capital leases and operating leases on their balance sheets. The new accounting standard is effective for public companies in 2019 and privately owned companies in 2020.

Companies with significant operating leases will experience an immediate increase in their assets and liabilities due to the new lease accounting standard. The balance sheet changes will impact financial ratios, which could have ramifications for businesses with a financial ratio debt covenant.

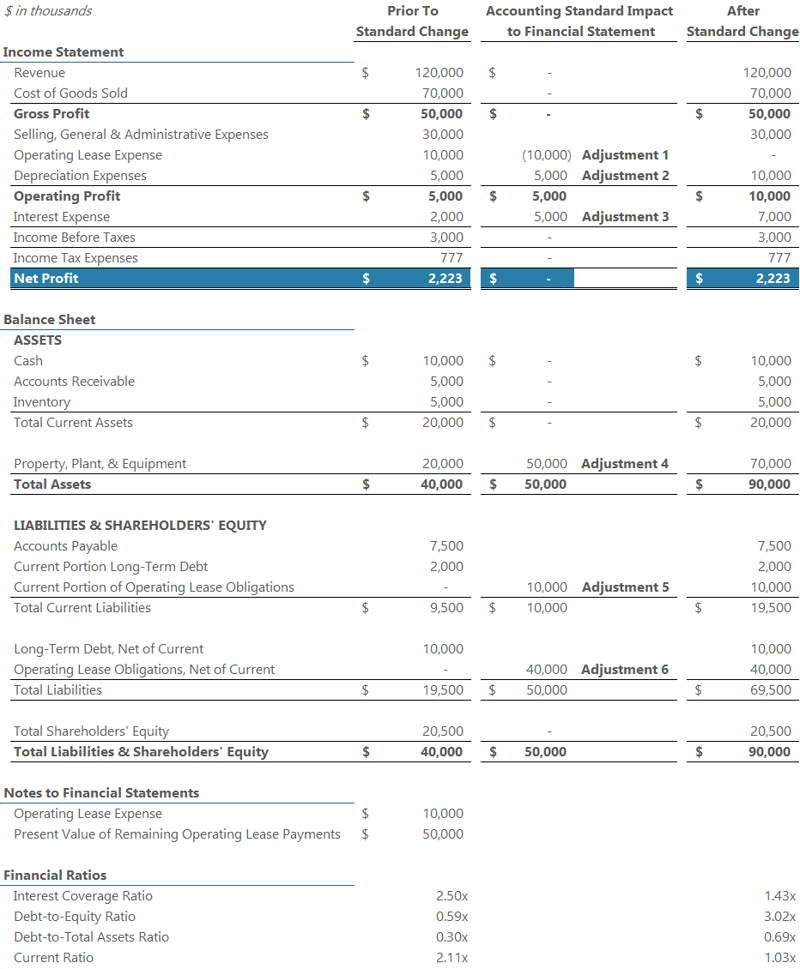

We identified six adjustments to convert financial statements to present operating leases under the accounting standard update. Below we provide brief descriptions of these adjustments and give an example to show the impact to financial ratios.

Adjustment 1 – Remove operating lease expense recorded on the income statement. This expense is no longer permitted since the operating lease will be shown on the balance sheet.

Adjustment 2 – Incorporate depreciation expenses related to the leased property on the income statement. Since the leased property now appears as an asset on the balance sheet, annual depreciation expense related to that asset is permitted as a reduction to taxable income on the income statement.

Adjustment 3 – Incorporate interest expense related to the operating lease to the income statement. Since the operating lease obligation appears as a debt liability, associated interest expense is permitted as a reduction to taxable income on the income statement.

Adjustment 4 – Increase Property, Plant, & Equipment for the present value of future operating lease obligations. The property being financed appears as an asset to the reporting company to offset the related debt liability.

Adjustment 5 – Increase current liabilities for the current portion of the present value of the future operating lease obligations. The current portion is the amount due on the operating lease in the next 12 months.

Adjustment 6 – Increase long-term liabilities for the present value of the future operating lease obligations, net of the current portion. A long-term operating lease, net of the current portion is the amount due on the operating lease beyond the next 12 months.

Since the operating lease is now counted as debt, the financial ratios involving debt have all weakened significantly. The change may cause the company to become non-compliant with covenants required by its debt agreements. We suggest companies with debt outstanding and significant operating leases follow these steps to determine the impact:

It can feel overwhelming trying to understand the accounting standards update, the impact on financial statements, and how to best proceed with current lenders. PCE has experience working with our clients to renegotiate their loan agreements with their lenders. Contact us today for more information.

1 Financial Accounting Standards Board (FASB). (July 2018). Accounting standards updated No. 2018-11. Retrieved from http://asc.fasb.org/

Investment Banking

New York Office

201-444-6280 Ext 3 (direct)

mmoran@pcecompanies.com

Connect

201-444-6280 Ext 3 (direct)

407-621-2199 (fax)