Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

ESOPs are attractive to business owners evaluating succession options, as they provide meaningful benefits to all core constituencies: selling shareholders, the company itself, and the employees. Much like selling your company to a third party, ESOPs are established by selling all or part of your business to an ESOP trust. Learn more about how an ESOP works and why it's a powerful succession planning tool.

The Advantages of ESOP Formation for Business OwnersThe majority of these sales are taxable events to the selling shareholder. Any business owner who sells their company for a gain, no matter the buyer, will be subject to taxation on the proceeds from the sale. The structure of that sale will dictate how much tax the business owner is subject to, and selling to an ESOP can eliminate the capital gains taxes altogether. Before making a decision, consider these three key questions when exploring an ESOP to ensure it aligns with your business goals.

In an asset sale, which is often an advantage to the buyer, the proceeds will usually be taxed at a blend of capital gains and ordinary income tax rates. In the sale of stock, which is often an advantage to the seller, the seller will only pay capital gains taxes. A sale to an ESOP guarantees a stock sale, which is already an advantage to the seller. It also potentially allows the seller to defer or avoid all taxes on the sale of their business. This tax advantage is unique to ESOPs. It is a strategy that comes with some complexity, but the potential tax savings can be significant.

The shareholders of the company must meet specific requirements to qualify for this tax deferral, also known as a 1042 tax deferral, named after the Internal Revenue Code section that codified it. Some of the requirements are relatively straightforward, while others are more complex and require significant analysis.

The key requirements are:

Based on this information, you might think the tax deferral strategy would be an automatic decision for a business owner selling to an ESOP. However, there are advantages to being or staying an S corporation. The analysis must be studied to determine the best path forward for the sellers and the company.

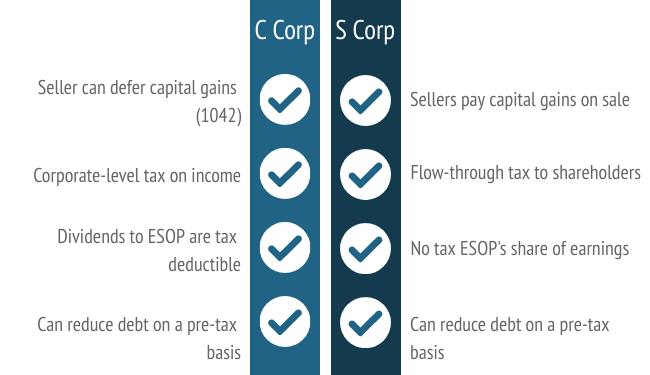

An ESOP trust, which is the legal shareholder in an ESOP construct, is required to own stock in a corporation. It cannot hold membership units in an LLC or an ownership interest in any other type of entity. This limitation requires the underlying company to be taxed as either an S corp or a C corp. As previously stated, to qualify for a 1042 tax deferral, the company must be a C corp at the time of the sale. However, being a C corporation comes with some negative attributes that should be examined before deciding which tax election the company will make in the future. Let’s look at a side-by-side comparison of C corporations and S corporations to determine what tax structure will be used or how companies decide which tax structure to use.

So while the shareholder has an advantage in the C corp scenario, the company clearly has an advantage in the S corp scenario, where it can become a tax-exempt entity. The decision often comes down to the comparison of how much capital gains the shareholder can defer in the C corp to how much free cash flow the company has in the S corp scenario. A feasibility study can provide valuable insights and help you make an informed decision.

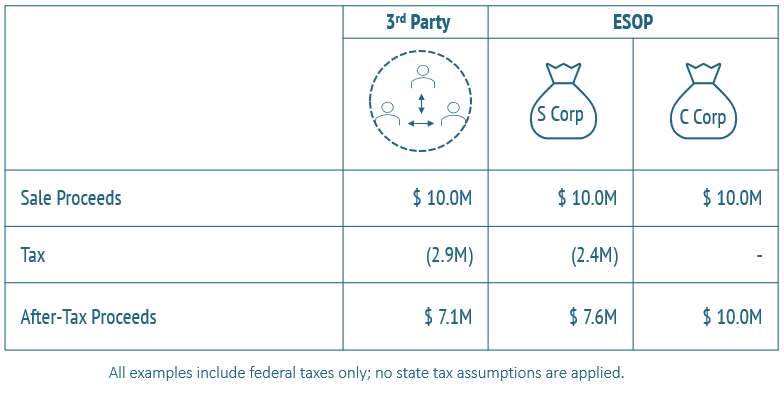

The difference can be considerable, depending on what the seller’s tax basis is and the stock that they are selling.

In a third-party sale, the proceeds are likely to be taxed at a blend of capital gains and ordinary income tax rates. That can be a significant tax bill on $10 million of proceeds―up to $2.9 million, which would yield about $7.1 million in after-tax proceeds.

In the sale to an ESOP in which the company remains an S corp, the seller will only be subject to capital gains taxes. The tax savings can raise the proceeds from $7.1 million to $7.6 million.

In the C corp scenario, where the seller can defer all their capital gains taxes, they can realize all $10 million of their proceeds on an after-tax basis.

QRP is a security issued by a domestic, taxable operating company. The securities can include common stock or bonds and often include floating-rate notes issued by the company. Floating rate notes are investments not commonly known outside the ESOP community. In fact, floating-rate notes are created specifically for ESOP transactions to satisfy the requirements of the 1042 capital gain deferral and are often referred to as ESOP bonds.

Floating-rate notes are attractive for ESOP transactions primarily because they are the perfect collateral for a margin loan issued by your investment advisor. This means you can invest in the floating-rate notes, defer the capital gain for an extended time, and still get to use most of the proceeds from your sale. Typically, up to 90% of those proceeds are usable by you, while 10% remain invested in the floating-rate notes, which results in a deferral of 100% of the capital gains over a long period. Typically, ESOP bonds last 40 to 50 years and defer the capital gain for that amount of time.

Companies that historically issue floating-rate notes are considered safe investments. These are well-known companies in which investors feel comfortable holding debt. Typically, they have a credit rating somewhere between A and AAA and, because they are specifically designed for these ESOP transactions and the owner of these floating-rate notes is saving a tremendous amount of tax by deferring their capital gains, they do not pay very much interest. They often pay at a discount to the London Interbank Offered Rate (LIBOR). Because LIBOR currently trades at very low rates, these bonds have very low yields. These bonds are not intended to be long-term investments on their own, and their best use is this deferral of capital gains taxes in an ESOP transaction.

Essentially, in a transaction, for every $10 million of gain deferral, you need to purchase $10 million of floating-rate notes. To do so, you will need $1 million of cash, which will be held as a long-term asset by you, the floating-rate owner. You will then have $9 million available from your $10 million sale, which you can spend, invest in a diversified portfolio, or use for other purposes as opposed to deferring the capital gain. So even though you need to leave $1 million invested in the QRP, the after-tax cash available is still more than that of the taxable sale. Also, the $1 million invested in the floating-rate notes is still value to you and your heirs, much like any other long-term investment.

The goal is to move this tax deferral from “a deferral” to “an elimination.” Because these bonds last for 40 to 50 years, they are intended to outlive you, the owner. Once the QRP is moved into your estate upon your passing, the basis in the floating-rate notes gets stepped up to the date-of-death value. This means it will pass on to your heirs, and the capital gain from the sale of your business is eliminated. Other active strategies can be executed in a shorter time frame. The QRP is often disposed of if you run into any investment losses, in order to offset the gains you realized in selling the QRP. Otherwise, there are sophisticated estate planning tools to move it out of your taxable estate. Consult with your estate planning advisors to investigate these strategies in detail.

In summary, a sale to an ESOP is taxed at capital gains rates with the opportunity to defer or completely eliminate taxes. Learn more about the tax incentives available for selling shareholders when transitioning to an ESOP. The ability to defer your capital gains taxes in the sale to an ESOP can provide significant tax savings for you, the seller. The critical aspect to examine is whether the C corp election is going to inhibit corporate cash flows in the future compared to the S corp. Understanding the impact of tax law changes on ESOP-owned companies can help business owners prepare for long-term financial stability. It needs to be carefully modeled and stress tested. The decision often comes down to how much gain the seller has in their stock and how much they can defer in taxes compared to how much taxable income the company can shield going forward. The good news is that the sale to an ESOP is extremely flexible.

This flexibility allows shareholders to customize their transaction to meet their needs and those of the company and its employees. If the capital gain deferral available under the ESOP structure makes sense for the business owner, then it is achievable and can provide significantly more after-tax dollars to that seller than are available with other types of liquidity strategies. If you are considering an ESOP or would like to discuss ESOPs in further detail, please reach out to us.

Selling your business is a major decision—why not choose a strategy that maximizes your proceeds, minimizes taxes, and secures your legacy?

Fill out the form below to contact our expert ESOP advisors today. Let’s discuss if an ESOP is right for you.

Investment Banking | ESOP

Orlando Office

407-621-2124 (direct)

wstewart@pcecompanies.com

Connect

407-621-2124 (direct)

407-621-2199 (fax)