Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Farmers understand the importance of planning to yield a fruitful harvest. The process includes preparing the seeds and soil, timing the planting and harvesting, and preparing the crops for the market.

Similarly, farm owners must plan for their eventual transition from their business. The average age of U.S. farmers is 58, with only 6% of farmers being under 35 years old. 1

It is not surprising that most farmers who are active today will retire soon, leaving behind few young farmers to take their place. Now more than ever, it is essential for farm owners to plan their transition.

As you begin to think about the future of your agriculture business, it is essential to understand what buyers are looking for. Now is the time to make your business more marketable by addressing areas that need improvement. Whether you are ready to sell or just interested in preparing for the future, here are some key processes that will strengthen your business and its marketability.

Buyers are always looking to diversify their risk. A farm that produces one type of crop is not as marketable as a farm with a diverse selection of produce. Farms that grow varieties of plants and raise varieties of livestock will have more stable incomes. As the price of one goes down, the price of another may go up. Here are a few of the best ways to diversify your farming business:

There is an opportunity here for you to diversify your business by performing additional value-adding processes. These include processing, drying, cooling, packaging, and other methods that transform your raw commodity into a new product. This can result in higher returns on investment, the opportunity to enter new markets, and better brand recognition for your products.

The recent changes in U.S. immigration policy could have a negative impact on the farming industry by increasing labor costs. Historically, unauthorized immigrants made up half of the U.S. crop farm workers. These illegal workers accept pay that is approximately 20% lower than what is paid to legalized workers. This expected rise in labor costs increases the need for advanced farming technology and innovative processes to maximize efficiency and maintain a competitive advantage.

Advancements in technology, including sensors, devices, and machines, can provide you with more data for robust decision- making. In the past, farmers applied water, fertilizer, and pesticides uniformly across their fields. With today’s precision agriculture technology, you can more accurately control and manage the inputs to your farm. Here are a few recent technology advancements revolutionizing the farming industry:

Increased health-consciousness in consumers has led to increased demand for organic produce. In 2017, organic sales in the U.S. reached nearly $50 billion, reflecting a 6.4% increase over the prior year, according to the Organic Trade Association.2 The USDA organic label is highly trusted and will lead to increased sales of your crops. A three-year transition is required for the USDA certification, but it can result in increased profitability.

Organic farming is a system of production, processing, and distribution that maintains biological integrity of the crop, beginning with the farm. The USDA organic certification provides consumers with assurance that their products are eco-friendly. This seal indicates that the product contents are 95% or more certified organic, which means the product is free of synthetic additives and not processed using genetic engineering.

Washington State University conducted a global study that shows organic agriculture is more profitable than conventional farming. Profit margins for organic agriculture were significantly higher than those for traditional agriculture.3 Additionally, consumers are willing to pay a premium for organic goods. The study found the actual amounts paid to organic farmers ranged from 29-32% above those realized by conventional farmers.4

There is market share in the organic foods industry that every conventional farmer should consider focusing on.

Contract farming provides farmers assurance that their outputs will be purchased under previously agreed- upon terms. Contracts with suppliers can also offer small-scale farms with partners along the value chain. These relationships reduce the risk of cost increases for seeds, fertilizers, and other inputs. This allows a potential buyer to have stronger confidence in future production costs, assurance in future markets, and access to production support.

Building these relationships with suppliers of inputs and buyers of output will also help improve your reputation and brand recognition within the industry. These contracted partners may even introduce you to new technology or processes that could improve your operations. Seek processors of your outputs, as they constitute a leading user of contracts . The guaranteed supply enables them to maximize the utilization of their processing capacity.

Before you make the decision to go to market, it’s critical you understand the financial position and economic value of your Company.

There are many key performance indicators (KPIs) specific to the agriculture industry that buyers will use to value your business. Using these measurement tools will provide you with a clearer picture of the financial health of your Company. Incorporating these tools into your farm management will also increase the profitability and production of your business.

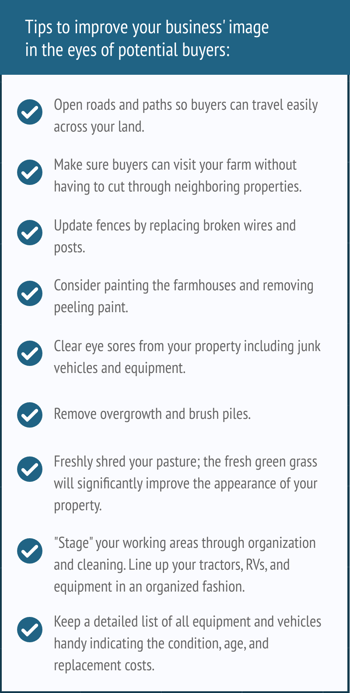

Your business model is strong, and your financials are stronger, but that barn could use a fresh coat of paint, and the fences are overdue for new posts. Buyers are going to perform their due diligence of your business and that includes site visits. While investors are most interested in the income generation aspect of your business, a cluttered shop or weathered assets may have a negative influence.

To prepare for questions from potential buyers, you should develop a strong understanding of your land and its characteristics. Be knowledgeable about the total acres of the land and its potential uses or restrictions. You should also know about any current or past environmental issues with the property and understand how fertile your soil is. You will need to have yield history reports to support your claims

Once you have that detailed understanding, you can turn your attention to preparing your land for potential buyers to tour. The following list of tips will help you get ready. These tips may seem mostly cosmetic, but they will support the business image you are seeking to convey to the potential buyers.

Now that your business is prepared for market, there are some additional decisions needed to find the perfect buyer. What are your long-term goals? Are you looking to retire and exit the business entirely? Or are you in need of some liquidity and want to continue working? Determine if you’re going to market the whole business or if you are interested in a partial sale. These decisions will have a significant impact on the types of buyers we market your Company to.

In recent years, farmland has grown significantly from a niche investment dominated by a few large insurance companies to an institutional real asset class attractive to retail investors. The NCREIF Farmland Index collects information from institutional farmland managers and calculates an index for U.S. farmland with the objective of increasing understanding of farm real estate as an institutional asset class.

With investment interest in farmland growing over the past few decades, farmland sale-leaseback transactions have become a popular structure for farm owners looking for liquidity. This alternative financing concept is where a farmer sells a parcel of land to an investor who then leases it back to the farmer. This method can be used as a means of liquidity for owners or as growth financing for the business.

Your decision on the size and structure of the transaction will dictate the types of buyers we market your Company to.

Historically, strategic buyers have been the most active buyers in the agriculture industry. These are buyers who operate in the same line of agriculture and who are looking for growth opportunities through acquisition. With increased global competition and emerging technologies, commercial farmers must continue to grow in order to remain competitive.

Typically, strategic buyers in this industry acquire farmland close to their current operations. Strategic buyers are interested in opportunities that will provide access to new markets, eliminate competition, enhance their production margins, or expand their business vertically up or down the value chain. Ultimately, they are looking for synergies with a potential acquisition and will pay a premium for it.

In the past, investors avoided the agriculture industry due to its capital-intensive nature. The industry is known for requiring substantial investment up front for equipment, seeds, and other goods before returns are seen. This long-term investing approach discouraged many investors. Today, many private equity firms are focusing on the agriculture sector with a buy-and-hold long-term investment strategy.

Investors recognize the agriculture industry is on the cusp of a transitional wave with the increasing average age of farmers and owners. Additionally, the world population is expected to reach 9.7 billion by 2050, according to the United Nations Department of Economic and Social Affairs.5 This represents an increase of approximately 2.2 billion people to feed over the next 32 years. To meet this demand, farmers will need more inputs for production, which increases demand along the agriculture value chain. This increase in demand for food, along with aging ownership, primes the agriculture industry for institutional investment.

Selling your business is a life-changing decision that must be made with care. It’s never too early to start preparing for your succession. Some of our most successful transitions started with conversations five years before the actual sale. We’re happy to discuss your particular business and provide value-adding strategies specific to your farm that you can implement now that will increase your value later.

To supplement this article, please refer to our Guide to Selling Your Business.

PCE has a team of credentialed investment bankers and valuation experts available to help you. Whatever you wish to accomplish, our team can define, analyze and present solutions that allow you to take the next step.

Visit our Exit Planning Library to find additional resources to help guide you through the exit planning process.