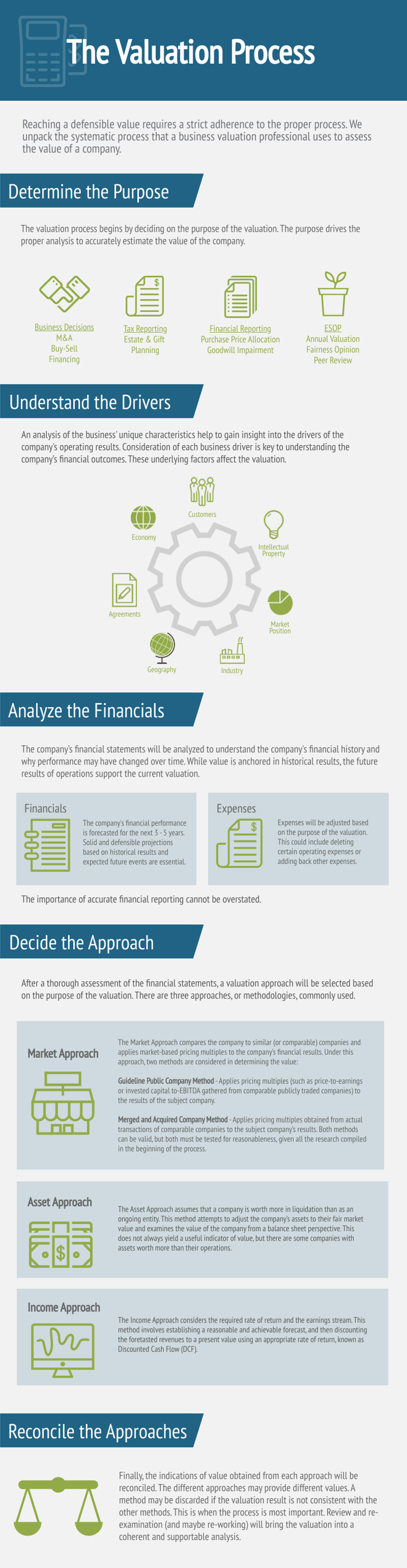

Reaching a defensible value requires a strict adherence to the proper process. We unpack the systematic process that a business valuation professional uses to assess the value of a company.

Determine the Purpose of the Valuation

The valuation process begins by deciding on the purpose of the valuation. The purpose drives the proper analysis to accurately estimate the value of the company.

Understand the Value Drivers

An analysis of the business' unique characteristics help to gain insight into the drivers of the company's operating results. Consideration of each business driver is key to understanding the company’s financial outcomes. These underlying factors affect the valuation:

- Customers

- Intellectual property

- Market position

- Industry

- Geography

- Agreements

- Economy

Analyze the Financials

The company’s financial statements will be analyzed to understand the company's financial history and why performance may have changed over time. While value is anchored in historical results, the future results of operations support the current valuation.

Financials

The company's financial performance is forecasted for the next 3 - 5 years. Solid and defensible projections based on historical results and expected future events are essential.

Expenses

Expenses will be adjusted based on the purpose of the valuation. This could include deleting certain operating expenses or adding back other expenses.

The importance of accurate financial reporting cannot be overstated.

Decide the Valuation Approach

After a thorough assessment of the financial statements, a valuation approach will be selected based on the purpose of the valuation. There are three approaches, or methodologies, commonly used in valuing a company.

Market Approach

The Market Approach compares the company to similar (or comparable) companies and applies market-based pricing multiples to the company’s financial results. Under this approach, two methods are considered in determining the value:

- Guideline Public Company Method - Applies pricing multiples (such as price-to-earnings or invested capital to-EBITDA gathered from comparable publicly traded companies) to the results of the subject company.

- Merged and Acquired Company Method - Applies pricing multiples obtained from actual transactions of comparable companies to the subject company’s results. Both methods can be valid, but both must be tested for reasonableness, given all the research compiled in the beginning of the process.

Asset Approach

The Asset Approach assumes that a company is worth more in liquidation than as an ongoing entity. This method attempts to adjust the company’s assets to their fair market value and examines the value of the company from a balance sheet perspective. This does not always yield a useful indicator of value, but there are some companies with assets worth more than their operations.

Income Approach

The Income Approach considers the required rate of return and the earnings stream. This method involves establishing a reasonable and achievable forecast, and then discounting the foretasted revenues to a present value using an appropriate rate of return, known as Discounted Cash Flow (DCF).

Reconcile the Valuation Approaches

Finally, the indications of value obtained from each approach will be reconciled. The different approaches may provide different values. A method may be discarded if the valuation result is not consistent with the other methods. This is when the process is most important. Review and re-examination (and maybe re-working) will bring the valuation into a coherent and supportable analysis.