What is an ESOP? A Tax-Advantaged Exit Strategy for Business Owners

Why Consider an ESOP for Your Business?

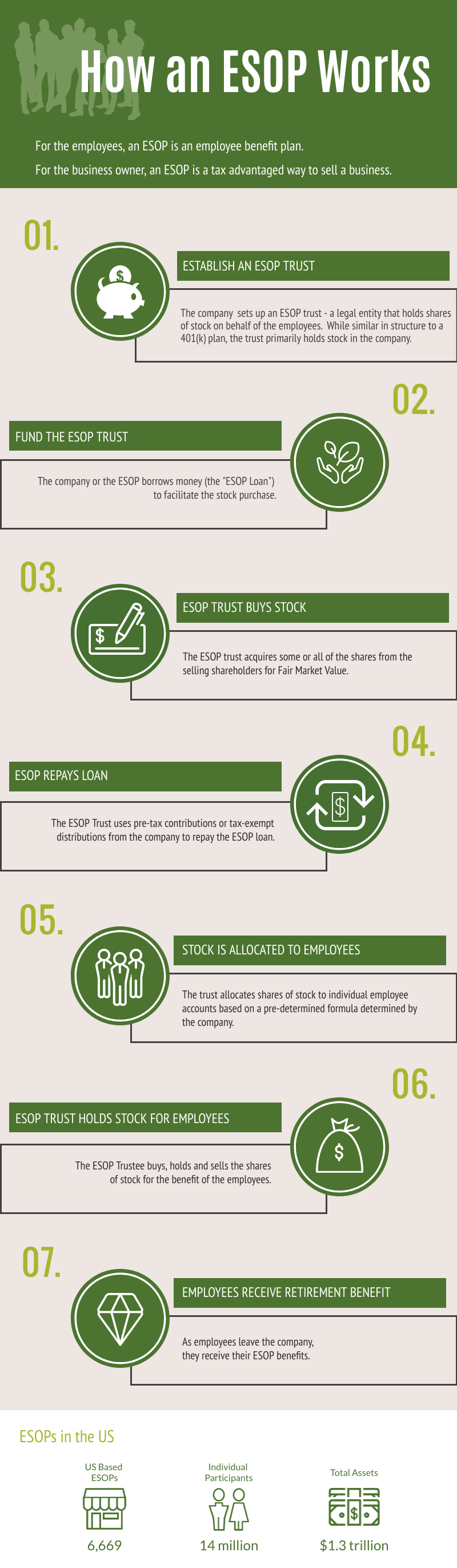

For the employees, an ESOP is an employee benefit plan. For the business owner, an ESOP is a tax advantaged way to sell a business.

Step-by-Step Guide: How an ESOP Works

-

Setting Up an ESOP Trust for Employee Ownership

The company sets up an ESOP trust - a legal entity that holds shares of stock on behalf of the employees. While similar in structure to a 401(k) plan, the trust primarily holds stock in the company.

-

Funding the ESOP: Using Loans & Company Contributions

The company or the ESOP borrows money (the "ESOP Loan") to facilitate the stock purchase.

-

Purchasing Stock at Fair Market Value

The ESOP trust acquires some or all of the shares from the selling shareholders for Fair Market Value.

-

How an ESOP Repays Loans with Pre-Tax Contributions

The ESOP Trust uses pre-tax contributions or tax-exempt distributions from the company to repay the ESOP loan.

-

Allocating Company Shares to Employees

The trust allocates shares of stock to individual employee accounts based on a pre-determined formula determined by the company.

-

ESOP Trustees Managing and Holding Company Stock

The ESOP Trustee buys, holds and sells the shares of stock for the benefit of the employees.

-

ESOP Payouts: Retirement Benefits for Employees

As employees leave the company, they receive their ESOP benefits.

Discover the ESOP Advantage – Maximize Your Exit Strategy

Selling your business is a major decision—why not choose a strategy that maximizes your proceeds, minimizes taxes, and secures your legacy?

Fill out the form below to contact our expert ESOP advisors today. Let’s discuss if an ESOP is right for you.