Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Most corporations in the large and upper-middle market segments achieve growth through acquisitions. Executing an acquisition strategy effectively can accelerate a company's growth by adding new products, services, and talent and expanding geographic reach, among other advantages.

To ensure success, many companies dedicate resources to work on nothing but acquisitions. Other companies assign these tasks to internal teams who handle transactions alongside their regular responsibilities. Adding an investment banker to your team is crucial to alleviate the operational burden during the acquisition process and to ensure successful transaction closure.

Data shows that leveraging the experience and expertise of an investment banker leads to a better process and better outcomes. Adding a seasoned investment banker to your deal team can help you accomplish several things:

Consider how a skilled advisor can help your company develop and execute a repeatable process to grow through acquisitions.

Proprietary deal flow is essential to any company that implements a buy-side strategy. An investment banker can identify potential sellers before they enter the market, connect you with business owners and advisors from their established network, and provide access to in-depth market research, aiding in the creation of a tailored list of acquisition targets.

By contacting multiple companies in a sector directly, you can start to develop relationships that position you as the first company a business owner contacts when considering a sale. As discussed in our article Acquisition Deal Flow Made Easy!, getting in front of business owners offers many benefits.

The acquisition deal process, comprising phases like identifying and assessing targets, managing due diligence, structuring transactions, and negotiating deals, is extensive and complex.

When you are actively seeking to grow your company through acquisition, implementing an efficient process will lead to better outcomes—but each step can be time-consuming. An investment banker can help in that regard by doing the substantial work necessary to establish clear criteria for your acquisition, develop a list of suitable businesses, and then make the first contact with target companies that have been properly vetted. Managing the deal process in this manner allows you to make informed decisions about which companies you might wish to acquire, even as you continue to focus on running your company.

After refining the list of targets and confirming mutual interest, the investment banker will drive the process onward, starting with data collection, analysis, and valuation. The last step is the most important because getting to a valuation range quickly helps both sides determine whether there is a deal to be made. If the seller thinks the company is worth $100 million but the buyer believes the real worth is $50 million, then a deal is highly unlikely. If both sides have closer expectations, however, they can quickly move the process forward, refining the valuation and potentially agreeing to key deal terms that will increase the odds of completing a transaction. An investment banker helps companies throughout this process, to the benefit of both parties.

Once you come to an agreement on the acquisition, both parties sign a letter of intent (LOI) memorializing the transaction. The next step is to conduct due diligence—a thorough review of the company’s data that nevertheless needs to progress at a reasonable pace to avoid deal fatigue, which can be fatal. An investment banker can help you through this stage of the process, too, which normally focuses on areas such as the following:

Much of this information must be requested and provided by the seller for your review. Dedicating specific resources to this due diligence process will help you prioritize key items and keep the seller on track to meet deadlines. An investment bank will also review the materials and flag potential issues for further investigation.

An investment banker not only aids in developing relationships with potential sellers but also helps in avoiding competitive deal processes and uncovering hidden opportunities. According to Capital IQ, 79% of sellers are not represented by an investment bank, so starting this outreach can ensure that the best transactions for your company are on your radar. The last thing you want is to learn that an ideal acquisition for your company was sold to someone else because you never knew it was for sale.

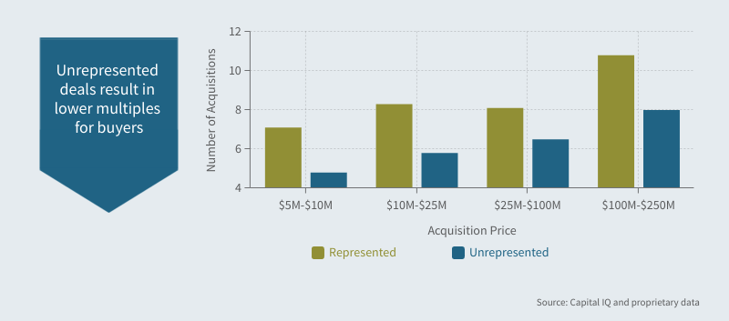

As a sell-side advisor, PCE sees the benefits of a competitive process—primarily, a better price and terms. As the chart below demonstrates, multiples are higher when the seller is represented by an investment bank. Capital IQ estimates that unrepresented companies sell for 20% to 32% less than those with an investment bank representing them. For you as the acquirer, the creation of this acquisition pipeline should lead to better valuations and more advantageous deal terms.

With an experienced investment banker on your team, you will receive effective counsel on the terms and structure of a potential deal. According to a study by Fairfield University Dolan School of Business, 100% of business owners felt that having an investment banker added value to their transaction process.

Experienced investment bankers understand the middle market and which deal terms/structures are appropriate. This insight will help you negotiate a fair LOI and purchase agreement that together will provide you with the appropriate protections. In addition, an investment banker should be able to provide creative structuring ideas to help bridge any valuation gaps, especially when the two sides don’t view value the same way. By proposing strategies that are fair, your deal team will demonstrate ways to overcome obstacles that might otherwise prevent a deal from being consummated.

Throughout the acquisition process, challenging conversations often take place surrounding value, structure, earn-outs, key deal terms, and diligence issues. For more difficult, often emotional conversations especially, it helps to have a third party, such as an investment banker, in place between buyer and seller. For you—as the buyer—to get as many anticipated benefits as possible, both parties need to work together; if the buyer-seller relationship breaks down, the benefits from the deal will most likely dissipate. In addition to providing a degree of separation, an experienced intermediary is familiar with being on the receiving end of any negative reactions and can translate either party’s reaction without offending anyone. An investment banker will be able to limit the emotion and still resolve the issue.

As a member of your deal team, an investment banker can also limit the “deal heat” that may impact the transaction. Deal heat occurs when either side gets too invested in a transaction and makes decisions that are not in their best interest—an outcome that should be avoided at all costs. Unfortunately, too many people, during an intense, emotional acquisition process, make decisions that they later come to regret. Having an impartial advisor at your side during these moments will help you avoid any future remorse.

***

Hiring an investment bank to advise on your acquisition process can help you capture unknown opportunities, accelerate the growth of your company, and create additional value. Partnering with an experienced advisor to implement the best possible strategy for you as a buyer will significantly increase your chances of success.

PCE has collaborated with numerous companies across multiple sectors to develop and execute successful buy-side strategies. If you're interested in learning more about how we can assist you and your company, please don't hesitate to get in touch.

Investment Banking

Chicago Office

224-520-1068 (direct)

nicolek@pcecompanies.com

Connect

224-520-1068 (direct)

407-621-2199 (fax)