Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

As a business owner, you may have noticed that operating your business in a time of rising tax rates has added a new layer of complication and planning. This type of economic environment may even prompt you (like many other business owners) to reassess your personal tolerance for risk, your desired holding period for your company, and your personal plans for working in the business—and to consider selling all or a piece of your company to an Employee Stock Ownership Plan (ESOP), which can offer greater flexibility for achieving your goals.

If you were planning to sell your business in the next few years, a potential tax increase may accelerate that action. You might also consider exiting ahead of schedule if the tax increase would substantially increase the risk involved in holding your company. By nature, these variables are different for each business owner. In the sale of your business to an outside buyer, they may conflict not only with one another, but with the goals of the counterparty. For these reasons and more, many owners of privately held companies evaluate selling to an ESOP to meet their objectives.

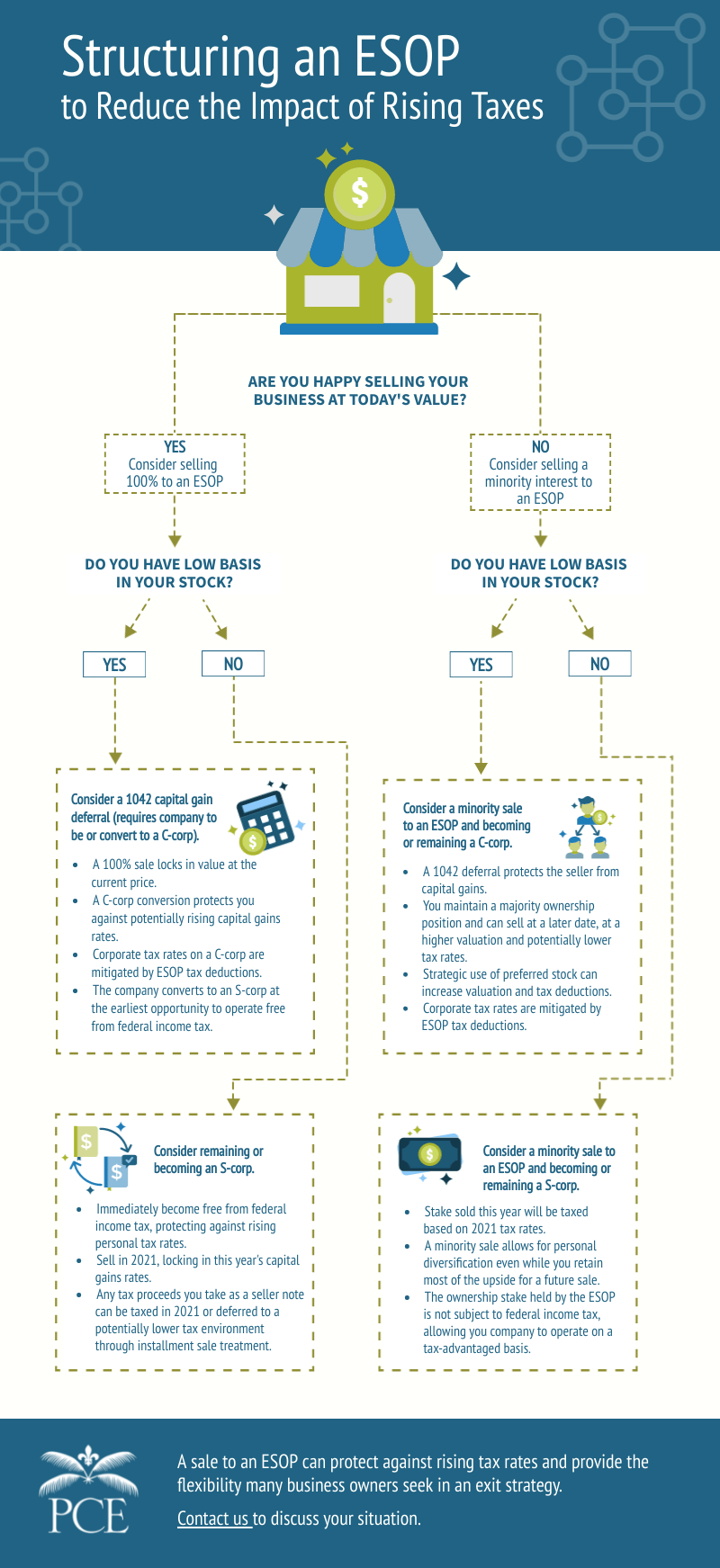

Consider the following scenarios that reveal how an ESOP can provide a solution for the challenge you are trying to solve as a business owner.

Scenario 1: You feel good about today’s valuation, were planning to exit in the next three to five years and want to act before tax rates increase.

Scenario 2: You want some personal diversification now, but prefer to hold some stock long-term.

Scenario 3: You want protection against rising tax rates, and have an undetermined hold period.

Consider which scenario sounds most appealing to you. How long should you hold your business? What are your exit strategy choices? Would a sale to an ESOP provide you with protection from rising tax rates and offer you greater flexibility? Our infographic (see below) can help you decide how to proceed.

What ESOP structure may be right for you and your business? The following flowchart can help determine how to reach your goals for your business in a rising tax environment.

Investment Banking | ESOP

Orlando Office

407-621-2124 (direct)

wstewart@pcecompanies.com

Connect

407-621-2124 (direct)

407-621-2199 (fax)