Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

If you are an early-stage company looking to raise capital from a venture capital or private equity firm, you have likely heard of preferred stock. But are you familiar with all their rights and features? Similar to common stock, preferred stock offers equity ownership in a company. Shareholders of preferred stock, however, have priority on dividends and earnings and have seniority on liquidation preferences.

Preferred stock not only has priority over common stock but depending upon the terms negotiated, preferred stock can convert or participate with common stock. These conversion and participation features could have a significant impact on the proceeds available to common stockholders.

This article will help you understand how preferred stock liquidation preferences, dividends, conversion features and participation rights impact your payout in a liquidation event.

Liquidation preferences determine the order in which proceeds will be distributed to various equity classes upon a liquidity event. Preferred shareholders usually receive proceeds before common shareholders upon such event. Liquidity events can be anything ranging from dissolution to an IPO, sale, or merger of a company.

Preferred shareholders receive proceeds before common shareholders upon a liquidity event, and at a minimum, those proceeds are typically equal to the initial contribution. Depending on how liquidation preferences are structured, preferred shareholders could receive significantly more than their initial contribution.

Preferred stock commonly has features similar to debt in that preferred shareholders receive dividends on their investment. Dividends can be paid out quarterly or annually, or they can accrue and even compound.

Depending on your company’s success, preferred shareholders may find it more beneficial to convert to common stock and participate in the proceeds as common shareholders. The rate at which preferred stock converts to common stock is normally agreed upon at the time of investment and is outlined in the preferred stock agreement or similar legal documents. The conversion rate is based on the terms negotiated, and is not always one-to-one. Preferred shareholders could achieve a significant return by converting to a much higher number of common shares. The conversion ratio may even be adjusted from time to time to prevent dilution of ownership due to subsequent financing rounds.

The level of participation by preferred shareholders can typically be categorized as follows:

Below are a few examples illustrating how proceeds from a liquidity event are distributed to various equity classes.

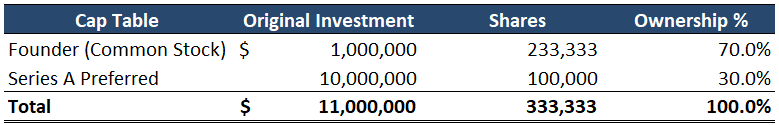

Startup, Inc. raised $10.0 million in a Series A financing round from a private equity firm. The hypothetical capital structure and features of the preferred are as follows:

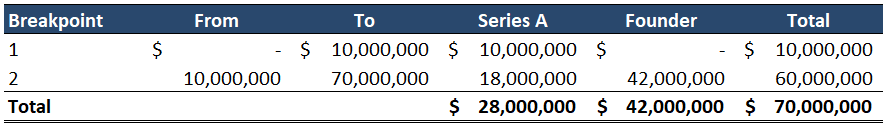

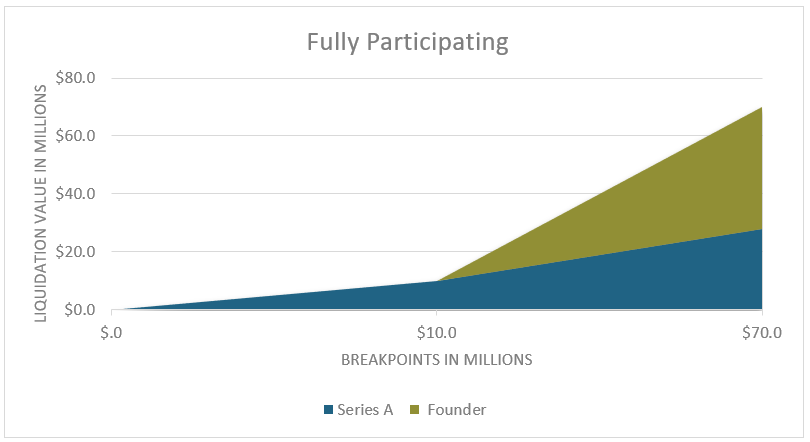

In this scenario, the Series A investor receives its preliminary liquidation preference of $10.0 million. Since the company sold for $70.0 million and the Series A is a participating preferred instrument in this scenario, Series A would participate pro rata with the founder in the additional proceeds and receive another 30.0% of the amount above the $10.0 million liquidation preference, or $18.0 million. The total proceeds received by the Series A investor would equal $28.0 million or 40.0% of the total proceeds, which is much greater than the 30.0% ownership interest. The chart below illustrates how each class participates based on the value of the company.

As illustrated above, the lower the value of the company, the more Series A receives as a percent of the total. To decrease the dilutive impact of a participating preferred investor, a non-participating or capped participation feature would be suggested.

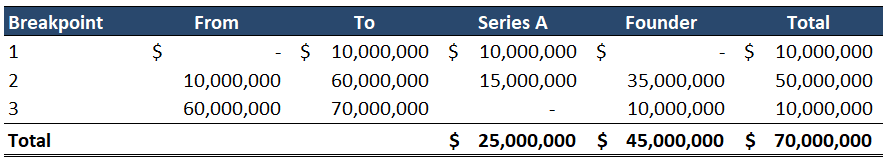

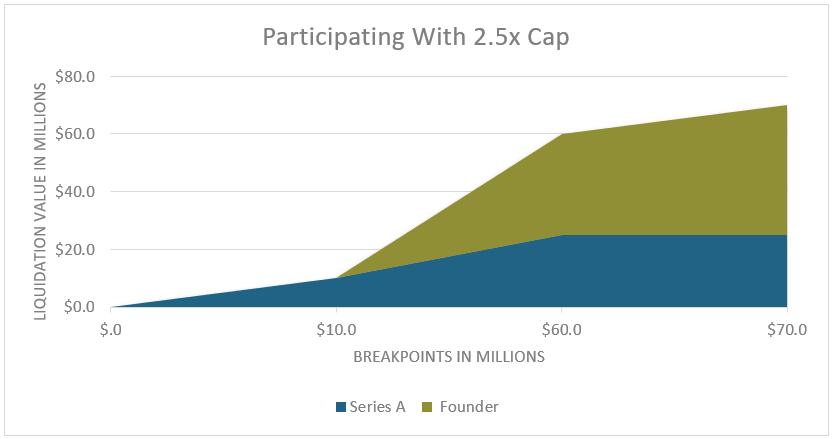

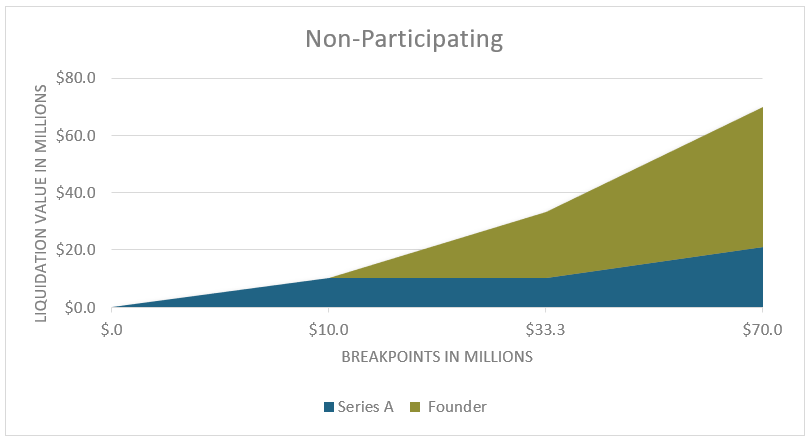

In scenario 2, the Series A investor receives its initial contribution or liquidation preference of $10.0 million. Proceeds above $10.0 million are then shared pro rata between the Series A investor and the founder until Series A receives its maximum benefit of $25.0 million (2.5x the original investment). The remaining amount ($10.0 million) is then allocated 100.0% to the founder. In this scenario, the Series A investor receives 35.7% of the total proceeds, compared to the 40.0% received in scenario 1. The chart below illustrates how the proceeds received by the founder increase substantially once the Series A investor achieves the 2.5x threshold.

As illustrated in this graph, Series A reaches a plateau once the $25.0 million threshold is achieved. What is not illustrated, however, is what happens in scenarios where the company sells for a higher price, and it would be more beneficial for the Series A investor to forgo their rights as a preferred investor and convert to common. To estimate this threshold, we would want to know at what company value the Series A investor would convert in order for it to achieve a greater benefit. In this scenario, given that Series A stops receiving benefit at $25.0 million, they would want to convert once their pro rata interest as a common shareholder is greater than $25.0 million. The answer is to simply divide the $25.0 million threshold by their pro rata portion of the equity, which in these examples is 30.0%. Accordingly, the Series A investor would likely convert to common at any value greater than $83.3 million ($25.0 million / 30.0% = $83.3 million).

While the dilution to the founder or common shareholder is not as significant as that in scenario 1, issuing preferred shares with even a capped participation feature can greatly reduce the proceeds to common shareholders. Issuing preferred shares with no participation feature is one way to help reduce dilution as outlined in the following scenario.

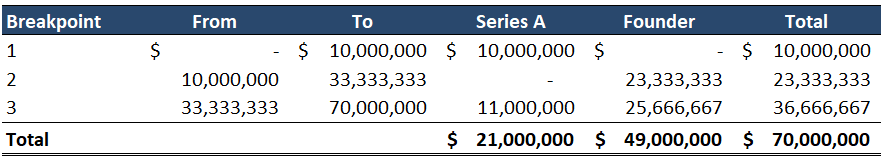

In scenario 3, Series A receives a liquidation preference equal to their original investment of $10.0 million and then no longer receives any proceeds, since it is a non-participating preferred security. Proceeds above the $10.0 million liquidation preference are then distributed 100.0% to the founder. Given Series A has the ability to convert to common stock, however, the Series A investor would exercise their right to convert when proceeds from a liquidity event exceed their $10.0 million preference. Similar to the conversion calculation we performed in scenario 2, the Series A investor would convert to common stock at a company value of $33.3 million ($10.0 million / 30.0% = $33.3 million). At any liquidation value above this threshold, the Series A investor would now be a common shareholder and receive 30.0% of all proceeds, maximizing their return. The following chart illustrates how proceeds are allocated based on company values.

This chart illustrates how the Series A investor receives the same payout if Startup, Inc. liquidates for $10.0 million or $33.3 million, but then receives increased proceeds once the value of the company exceeds $33.3 million.

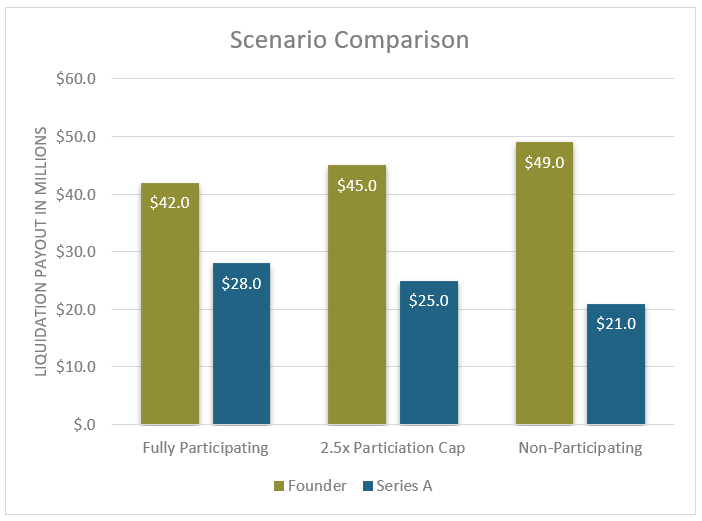

The following chart compares the proceeds resulting from the three scenarios:

It is not surprising to see that when preferred investors do not participate with common stock, the total return to the common shareholders is maximized and, in our example, the founder’s distribution totaled $49.0 million. Preferred stock that fully participates results in the least amount distributed to common shareholders. In our examples, the preferred investor did not receive any dividends, which is uncommon. Had the preferred investor received dividends, the proceeds received by the common shareholders would have been reduced even further under all scenarios.

Even when preferred stock does not participate as common stock, but has the ability to convert to common stock, the common shareholders are still forgoing their full potential. In order to fully mitigate any dilution, you would be best served to issue preferred stock with no participation or conversion features. This type of preferred instrument would be similar to that of a debt instrument in that once liquidation is achieved, only the initial investment and dividends are paid to the preferred investors, allowing the common shareholders to benefit from all the upside.

Valuation

pvogt@pcecompanies.com

Atlanta Office

407-621-2100 (main)

678-641-4760 (direct)

407-621-2199 (fax)