Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Updated 8/2025

If you're considering selling your business, understanding EBITDA—Earnings Before Interest, Taxes, Depreciation, and Amortization—is crucial. Buyers, investors, and lenders rely on EBITDA to assess your company's financial performance and compare it to industry peers. But what exactly is EBITDA, why is it important, and how is it calculated?

By the end of this blog, you’ll have a clear understanding of how EBITDA affects the sale of your business and what you can do to maximize its value.

EBITDA is a financial metric that measures your company’s profitability by focusing solely on its core operations. It excludes:

By stripping away these factors, EBITDA provides a clearer picture of your company's true earning potential, regardless of financing decisions, tax strategies, or accounting policies.

When selling your business, potential buyers want to assess its core profitability and cash-generating ability. EBITDA allows them to:

The formula to calculate EBITDA is straightforward:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Let’s break it down:

By following this approach, you'll obtain a clearer view of your company’s core earnings potential.

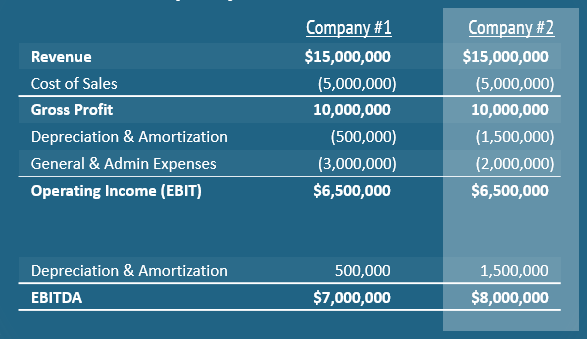

Consider two companies in the same industry with identical revenue:

At first glance, you might assume Company #1 is the better performer based on its higher net income. However, after calculating EBITDA, we see that Company #2 actually generates more cash, making it a more attractive investment opportunity.

This example illustrates why buyers and investors focus on EBITDA rather than net income to assess the true profitability of a business.

If you're preparing to sell your business, maximizing EBITDA can directly increase its valuation. Buyers typically use an EBITDA multiple, such as 4x or 6x EBITDA, to determine the purchase price. A higher EBITDA means a higher valuation.

To determine valuation, buyers or M&A advisors consider:

Most middle market companies are valued using an EBITDA multiple, typically between 4x and 8x, depending on the industry, risk profile, and growth outlook.

For a more accurate valuation, it’s important to work with an experienced M&A advisor. They’ll benchmark your company against real transactions and provide a defensible range based on your specific market.

While EBITDA is a great starting point, Adjusted EBITDA provides a more refined view by adding back non-recurring, discretionary, or non-operational expenses. This can include:

Buyers often prefer adjusted EBITDA, as it offers a clearer picture of the company’s earnings potential under new ownership.

Read PCE’s Add-backs blog to learn how adjusted EBITDA can help you defend a higher valuation.

If you're considering selling your business, understanding and optimizing EBITDA is crucial.

At PCE Companies, we specialize in helping business owners like you prepare for a successful sale. Our team can analyze your EBITDA, identify areas for improvement, and guide you through the selling process.

By implementing these insights, you'll be well-prepared to present your business in the best possible light when the time comes to sell.

Ali Masoud

Ali Masoud is a Director in PCE’s M&A practice, specializing in buy-side and sell-side transactions, recapitalizations, and corporate advisory services. With deep expertise in software and technology deals, Ali brings extensive experience from top global investment banks and a background as a Turnaround CEO.

Investment Banking

New York Office

201-444-6280 Ext 3 (direct)

mmoran@pcecompanies.com

Connect

201-444-6280 Ext 3 (direct)

407-621-2199 (fax)