- Home

- FINANCIAL SOLUTIONS

- MERGERS & AQUISITIONS

SOLUTION

Mergers and Acquisitions Advisory for the Middle Market

Selling? Buying? Growing? We’ll help you achieve whatever you’re planning to do.

Mergers and Acquisitions quick links:

Share your vision with us. We’ll show you how to make it possible.

Our clients have big goals. Some envision the day they can open their doors in a different city, and others are looking to add top-shelf talent to strengthen their team. A few are looking to hand over the reins — as soon as they find the perfect successor.

Whatever you wish to accomplish, you can count on our experienced team to define, analyze, and present solutions that take you to the next step. And while you stay focused on what you do best, we’ll focus on what we do best: finding the deal that's best for you.

resource

The Complete Guide to Selling Your Business

From determining your objectives to taking control of your exit, learn the key concepts and strategies that will help you maximize the value of your business and ensure a successful transaction.

Mergers and Acquisition Services

Buy-side

Bringing only the best targets on board, structuring the transaction, and smoothly negotiating the deal.

Testimonials

What our clients say

We remain grateful for our trusted partnership with PCE. PCE played a critical role in the structure and negotiations of this acquisition and we couldn’t be more pleased with the outcome.”

- Bob Dill

- Hisco, Inc.

President

What a great experience we had working with PCE. They were completely responsive to our needs and were always two steps ahead, leading us expertly through a very complicated process. PCE helped to take a lot of the pressure off of our decision-making. I can’t imagine having done this without them.”

- Dennis Buhring

- Physician Associates

CEO

PCE ran a great process that provided an optimal outcome for me and my team. I greatly appreciate all of their hard work. My goals for the sale of the company my family built have been surpassed.”

- Douglas Zak

- Zak Incorporated

President

PCE has been a trusted advisor formally and informally over the years. I appreciate their guidance throughout this process.”

- Delynn Burkhalter

- Burkhalter

President & CEO

PCE did a great job and found a great home for the company [we] built. PCE worked tirelessly to get us the best deal possible. We are very pleased with the outcome and appreciate all of PCE’s hard work during this process.”

- Andrew Freedman

- Design Display Group Inc.

President

We are grateful for the advisory support we received from PCE in helping us find the best buyer for our family-owned business. PCE listened and understood the issues important to us which allowed us to obtain our goals for the transaction.”

- Lee Jones

- Florida Metal Products, Inc.

President

We have a longstanding relationship with PCE. For more than 20 years, we have trusted the folks at PCE to assist FIS Outdoor with various engagements. We knew we could count on their experience to lead us through a successful transaction and we are extremely pleased with the results.”

- Jon Tannler

- Florida Irrigation Supply (FIS Outdoor)

President

Main Contacts

Our team of highly qualified specialists puts their complete scope of expertise at your disposal. You’re in the best hands.

Joe Anto

Managing Director

Joe Anto is a Managing Director in PCE’s investment banking group. With more than 20 years of finance, M&A, and C-level experience in various industries, he is well-equipped to advise middle market clients on potential M&A and financing opportunities.

Throughout his career, Joe has executed more than $3.5 billion in M&A and financing transactions across a variety of sectors. As a former business owner and C-suite executive, Joe understands the challenges clients face when evaluating strategic transactions.

Prior to joining PCE, Joe was CEO and CFO for a publicly-traded retail and pharmacy chain with 550+ stores and $2 billion+ in revenue. Joe also served as SVP of M&A and Investments for one of the largest newspaper holding companies in the U.S. Earlier in his career, Joe served as Director of Investments for a distressed and special situations hedge fund and also worked in venture capital and investment banking.

Certifications & Affiliations

- FINRA Series 24 and 79 Securities License

- Member - Association for Corporate Growth, South Florida Chapter

Education

- Emory University, BBA with Concentrations in Finance & Information Technology

- Columbia University, MBA with Concentration in Finance

Nicole Kiriakopoulos

Director

As Director of PCE’s investment banking group, Nicole Kiriakopoulos leverages her strong business and technical background to effectively support middle-market clients through buy-side and sell-side engagements.

With nearly 20 years of experience, Nicole has participated in more than 100 M&A and financing transactions totaling more than $1 billion in transaction value across various sectors, with an emphasis on facility services. She has extensive experience in the residential and commercial HVAC, waste and sustainability, medical waste, patient communications, software, clean room, and secure document destruction industries.

Before joining PCE, Nicole worked at a boutique investment bank where she led the sale of multiple facility service companies. Previously she gained extensive buy-side M&A experience during her tenures at Reedy Industries, LLC and Stericycle, Inc.

Certifications & Affiliations

- CPA Candidate

Education

- Northern Illinois University, Bachelor of Science in Accountancy

Ali Masoud

Vice President

Ali brings a wealth of experience and a proven track record of success to PCE's M&A practice. As Vice President, he spearheads critical deal execution, from crafting compelling presentations to managing meticulous due diligence processes. Ali specializes in buy-side and sell-side mergers and acquisitions, recapitalizations, and general corporate advisory transactions.

Prior to joining PCE, Ali honed his expertise at several globally recognized investment banking firms, leading transactions across diverse industries, including a strong focus on software and technology. He possesses a deep understanding of the entire deal lifecycle, having actively participated in origination, execution, and post-closing support. His proven ability to effectively manage teams and clearly communicate with stakeholders has been instrumental in closing numerous successful deals.

Ali's qualifications extend beyond his financial acumen. He holds a Master's degree in International Finance and Economics, bringing a strategic mindset to every transaction. His experience as a Turnaround CEO further underscores his adaptability and problem-solving skills. With his collaborative spirit and passion for the industry, Ali is committed to delivering exceptional results for our clients.

Certifications & Affiliations

- FINRA Series 7, 63 and 79 Securities License

- Member - Association for Corporate Growth, New York Chapter

Education

-

Columbia University, School of International and Public Affairs, Master of International Finance and Economics

-

University of New Mexico, Master of Science, Physics

Michael Poole

Managing Director

Fueled by an internal drive for success, Michael Poole has been at the helm of PCE for nearly two decades. His dedication has built a middle-market investment banking, valuation and advisory firm that is without peer.

During this time, Michael has been instrumental in cultivating PCE’s philosophy of teamwork, industry leadership, and client focus. He finds his greatest satisfaction in helping business owners identify unique and imaginative strategies to meet their goals. Michael understands the importance of putting his clients’ needs first, always recommending ideas and tactics that he himself would pursue.

Michael has nearly 30 years of M&A and corporate finance experience within the public and private sector, with an emphasis on the Building Products, Construction & Engineering, and Finance industries. Over the course of his career, he has personally handled more than $1 billion in transactions in North America, Europe, Asia and Australia.

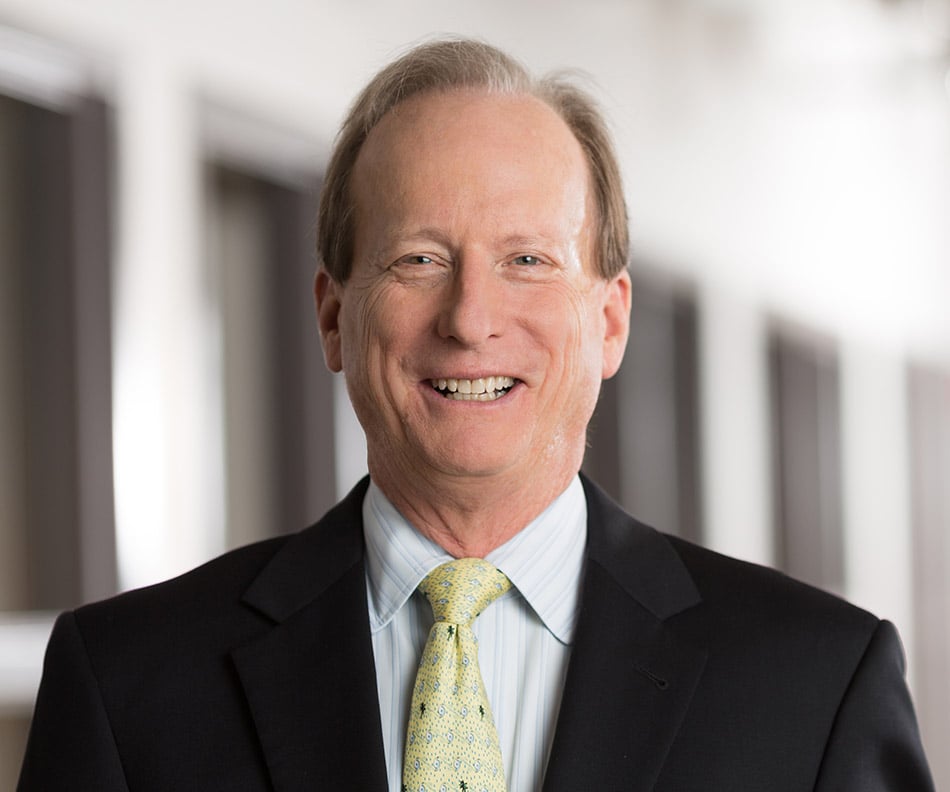

Michael Rosendahl

Managing Director

Michael Rosendahl leads PCE’s investment banking practice. He has more than two decades of investment banking and corporate development experience, with an impressive track record of guiding high-profile clients on the optimal timing for their transactions. Mike combines critical analysis with a creative approach to ensure that deals are made with his clients’ best interests in mind. He has been published in various industry journals and has gained widespread respect, often presenting at conferences.

Mike has developed considerable industry knowledge in various sectors, with a particular focus on industrial manufacturing, distribution and services, power, and heavy transportation.

Prior to joining PCE, Mike worked with a middle-market boutique outside New York City, where he managed the sale of multiple companies. He also has held director-level positions at an electronic brokerage firm, where he led investments and acquisitions for the fintech, financial services, and exchange sectors.

Certifications & Affiliations

- Chartered Financial Analyst (CFA) Charter Holder

- FINRA Series 7, 24 and 79 Securities Licenses

Service

- Member – Specialized Carriers & Rigging Association (SC&RA)

- Member – Association for Corporate Growth, New Jersey Chapter

- Member - Tulane Fund Advisory Board

- Member – CFA Institute

- Member – New York Society of Security Analysts

- Former Committee Chair – Allied Industries Committee

- Former member – CFA Society of Orlando (board member, 2008–2011)

Education

- BA, Economics, Tulane University, New Orleans, LA

- MBA, The Marshall School of Business, University of Southern California, Los Angeles, CA

Woody Whitcomb

Director

Take the next step

Complete the form below, and we’ll contact you to discuss your business goals and aspirations.

Resource Center

Explore our storehouse of market-leading information and intelligence.